Although we’ve heard recently from people in real estate who paint a gloomy picture about homebuyer appetites drying up in late spring or early summer—as inflation-fighting interest rates were punched up and prognosticators foresaw a wobbly economy ahead—evidence of a bonkers market still abounds around Atlanta. For instance:

There’s the 2008 modern dwelling in Old Fourth Ward that listed at $1.5 million last month and, according to its original architects, instigated a bidding war.

Across town is a lovely, 1920s renovation in Westview, now pending, that had listed for $850,000 in June—and then jacked up its asking price by $100,000.

And in Kirkwood, a distinctively modern, $1.15-million home has been under contract since it was little more than a wooden frame on a high corner lot.

But anecdotes like those could increasingly be anomalies, especially in the metro market at large, according to a new report from Georgia MLS.

The GAMLS Housing Market Snapshot for July in metro Atlanta indicates the market is in the process of “normalizing” after more than two years of historic, pandemic-era gains and lack of supply, according to officials with the statewide database.

A row of BeltLine-fronting townhomes in Old Fourth Ward, one of Atlanta's hottest neighborhoods for real estate over the past decade. Shutterstock

A row of BeltLine-fronting townhomes in Old Fourth Ward, one of Atlanta's hottest neighborhoods for real estate over the past decade. Shutterstock

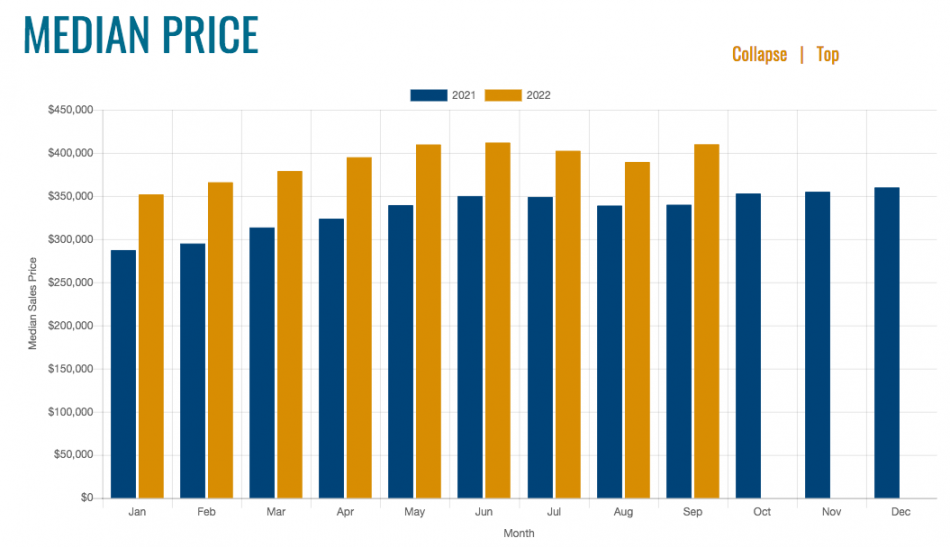

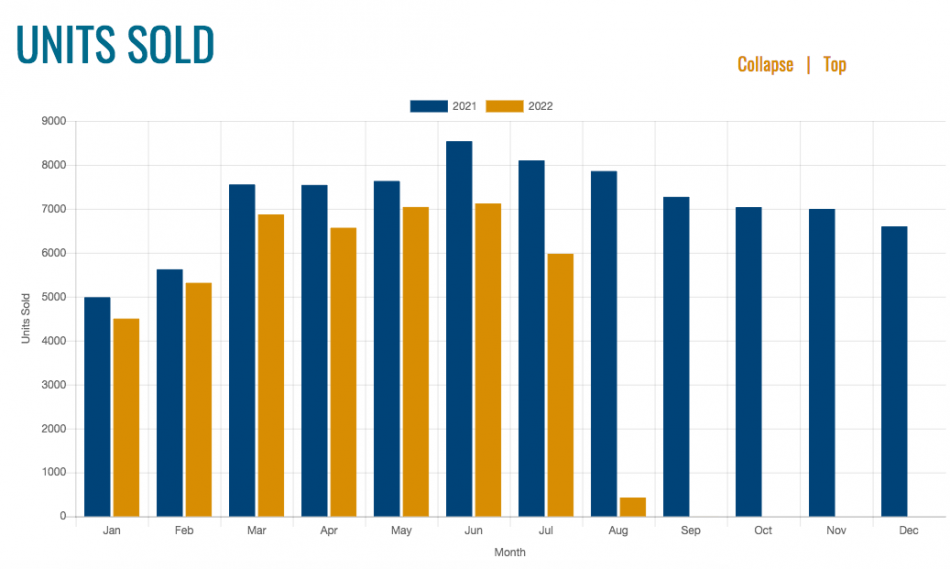

Since June, the number of housing units sold, new listings, overall sales volume, and yes even median housing prices have all dipped—in what's traditionally the hottest season for home sales all year. (Across the metro, average home prices still remained at a relatively astronomical $402,500 in July, however, after dropping by 2.3 percent.)

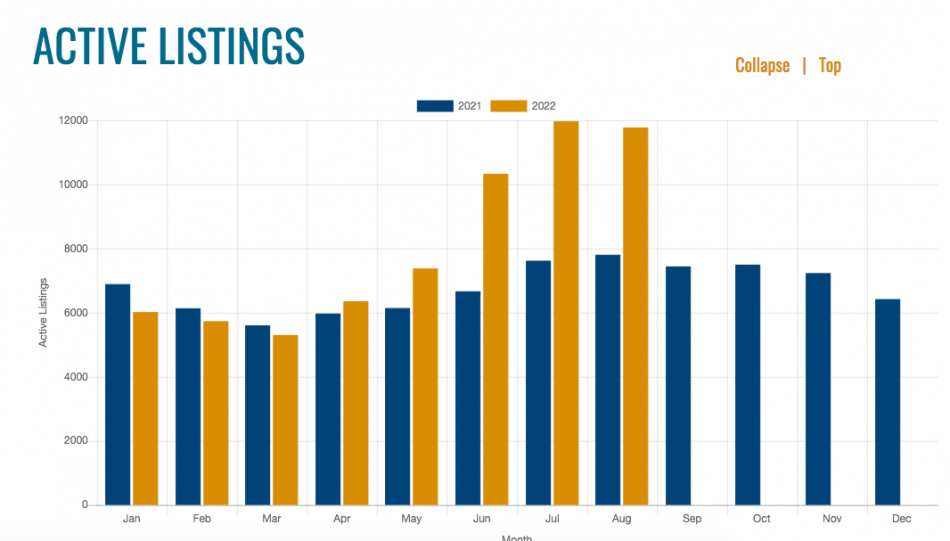

The only month-over-month metric to trend upward was active listings, which grew by nearly 16 percent since June, according to GAMLS data.

The stats reflect the situation in 12 counties GAMLS considers metro Atlanta: Cherokee, Clayton, Cobb, DeKalb, Douglas, Fayette, Forsyth, Fulton, Gwinnett, Henry, Paulding, and Rockdale counties.

The sheer number of home sales is down across Georgia and Atlanta, according to GAMLS, but prices have not dipped everywhere.

A broader timeline shows that between July 2021 and last month the number of active listings in metro Atlanta has ballooned by more than 57 percent. The number of units sold each month fell by more than 26 percent.

Yet median sales prices were still 15 percent higher than they were in the middle of last summer.

A few of the more interesting GAMLS findings, in graphic form:

What are you seeing out there, people (and agents) of Atlanta? Is tight supply in the city still a dominant factor?

Is it too early—or even way too early—to declare this a buyer’s market?

• Report: Almost all new Atlanta apartments qualify as 'luxury' (Urbanize Atlanta)