The recent news that Atlanta Botanical Garden’s forthcoming expansion includes a land swap deal that will create a new self-storage facility at the doorstep of Piedmont Park and the BeltLine didn’t sit well with everyone. Especially irked were urbanists pulling for more active land uses as intown parcels grow increasingly scarce and the city’s affordable housing crunch lingers.

“This is terrible for the neighborhood and the BeltLine,” one peeved Atlantan wrote to Urbanize via email, regarding the self-storage facility planned near the junction of the Eastside Trail and Monroe Drive. “Not at all the direction we should be heading.”

But the Virginia-Highland plans are a microcosm of a much larger development trend—and one that’s more pronounced in metro Atlanta than most other cities.

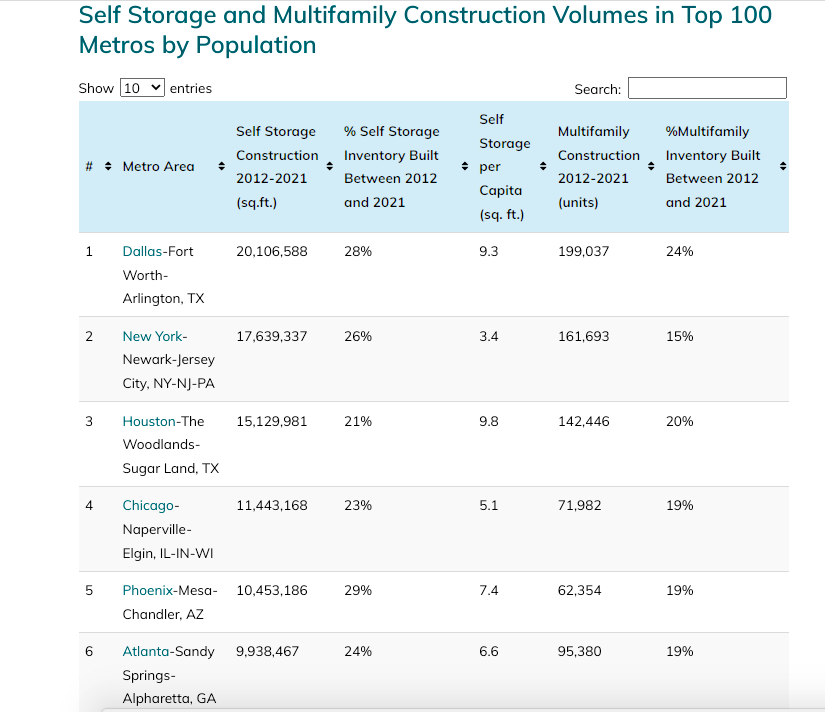

That’s according to RentCafe’s self-storage division, which recently found metro Atlanta packed on the sixth most self-storage space in the U.S. over the past decade as the population swelled and construction of space-restricted apartments boomed across the metro.

Between 2012 and 2021, according to RentCafe’s findings, metro Atlanta added 9.9 million square feet of self-storage facilities—a 24 percent bump in total inventory.

That’s equivalent to five times the square footage of downtown’s Mercedes-Benz Stadium. For stuff lockers.

The updated facade of a longstanding self-storage facility overlooking the BeltLine's Eastside Trail, Piedmont Park, and Midtown's skyline. Google Maps

The updated facade of a longstanding self-storage facility overlooking the BeltLine's Eastside Trail, Piedmont Park, and Midtown's skyline. Google Maps

That also means the Atlanta metropolitan area now offers 6.6 square feet of self-storage space for every single person, though that’s in line with the national average. (The metro’s in-migration and increased demand for self-storage have also bumped up rents to around $112 monthly for a standard 10-by-10-foot unit.)

If that all stings, the stats forecast gets worse: More than 1.4 million square feet of self-storage space is set to be delivered across metro Atlanta in the next two years, according to the analysis.

While self-storage facilities are typically lifeless voids in city settings, they can play important roles as people move or transition their lives, especially in the wake of what’s known as the four Ds: dislocation, death, divorce, and disaster. The COVID-19 pandemic also exacerbated the self-storage boom as people purged their homes to make room for offices, gyms, and play spaces.

An earlier, perhaps more troubling report by RentCafe found the vast majority of Atlanta’s self-storage development—87 percent—is located in urban areas. And almost all of that space has come in the form of new buildings.

If there’s a silver lining for self-storage haters in RentCafe’s recent, Yardi-supported findings, it’s that metro Atlanta didn’t even build half the square footage (20.1 million) logged by the No. 1 metro for self-storage construction, the Dallas-Fort Worth metroplex, between 2012 and 2021.

But on the downside, metro Dallas’ apartment construction was also more than double Atlanta’s in that time period.

How Atlanta stacks up among leading metros in apartment and self-storage construction over the decade ending last year. RentCafe

How Atlanta stacks up among leading metros in apartment and self-storage construction over the decade ending last year. RentCafe

• Analysis: Atlanta among top markets in commercial real estate growth (Urbanize Atlanta)