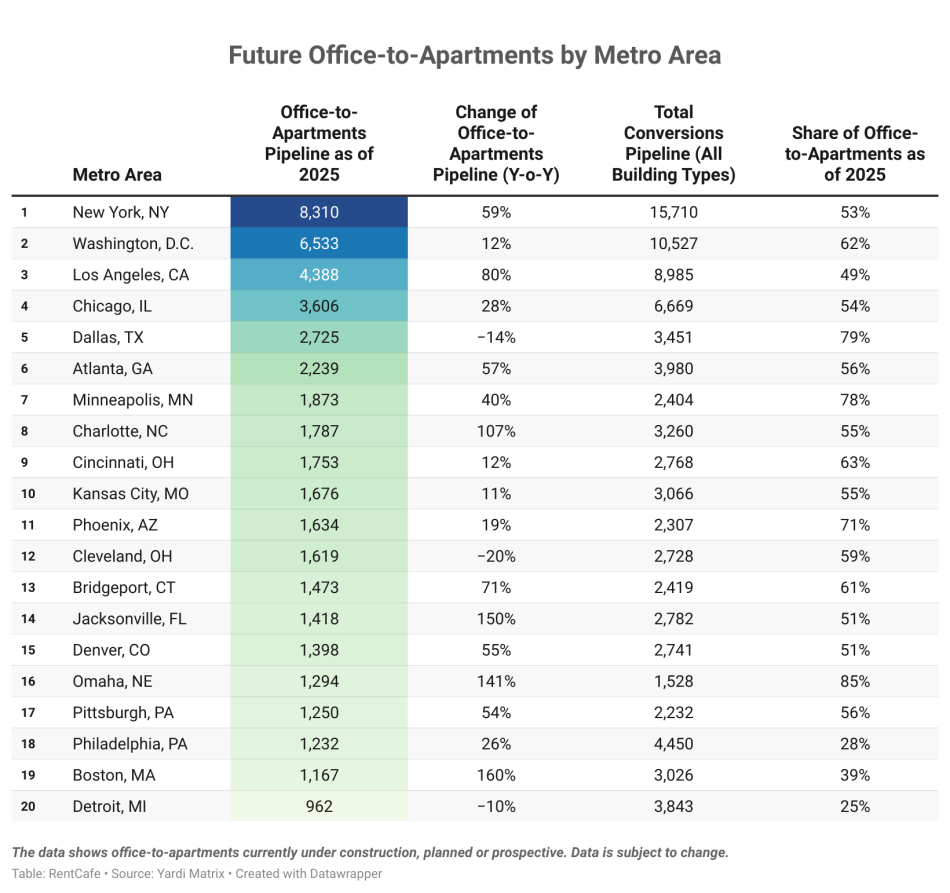

Just last year, Atlanta lagged behind several much smaller U.S. markets when it came to the sheer number of former offices being converted to rental units. But that appears to be changing.

Boosted by conversion proposals in towering downtown buildings, such as the 51-story Georgia-Pacific Center skyscraper and 2 Peachtree, Atlanta has emerged as the nation’s sixth biggest retrofitter in terms of repurposing older offices as places for people to live.

That’s according to new findings by national apartment search platform RentCafe, which show that office-to-apartment conversions have exploded across the U.S. from 23,100 units in 2022 to nearly 71,000 today, setting a new record.

Not surprisingly, mammoth New York City now leads the retrofitting pack, with 8,310 units currently in some stage of adaptive-reuse development.

Atlanta counts 2,239 units set to come to life through conversion soon. That’s good for the third most in the South—if you count Washington D.C. as the South—according to the analysis.

Speaking of D.C., it’s now the only smaller metro with more conversion units coming—6,533, good for No. 2 in the country—than Atlanta on RentCafe’s ranking of the top 20 markets.

Atlanta notched an impressive 57 percent year-over-year jump in the number of conversions proposed. But whether that momentum can continue remains to be seen, as the analysis indicates just 6 percent of Atlanta’s existing office space is suitable for conversion to living spaces. That’s well below the national average of 14 percent.

That 6 percent, however, is more than 14 million square feet of suitable office floorspace across Atlanta, or what RentCafe analysts called “plenty of opportunities for future projects.”

By comparison, for context, Los Angeles counts a whopping 83 million square feet of convertible office space—six times Atlanta’s count. But competing markets such as Nashville, Austin, and Phoenix each have less than 6 million square feet ripe for conversion.

Overall, according to RenCafe’s findings, the South has emerged as the region with the most office-to-residential units (22,000 total) coming down the pike.

…

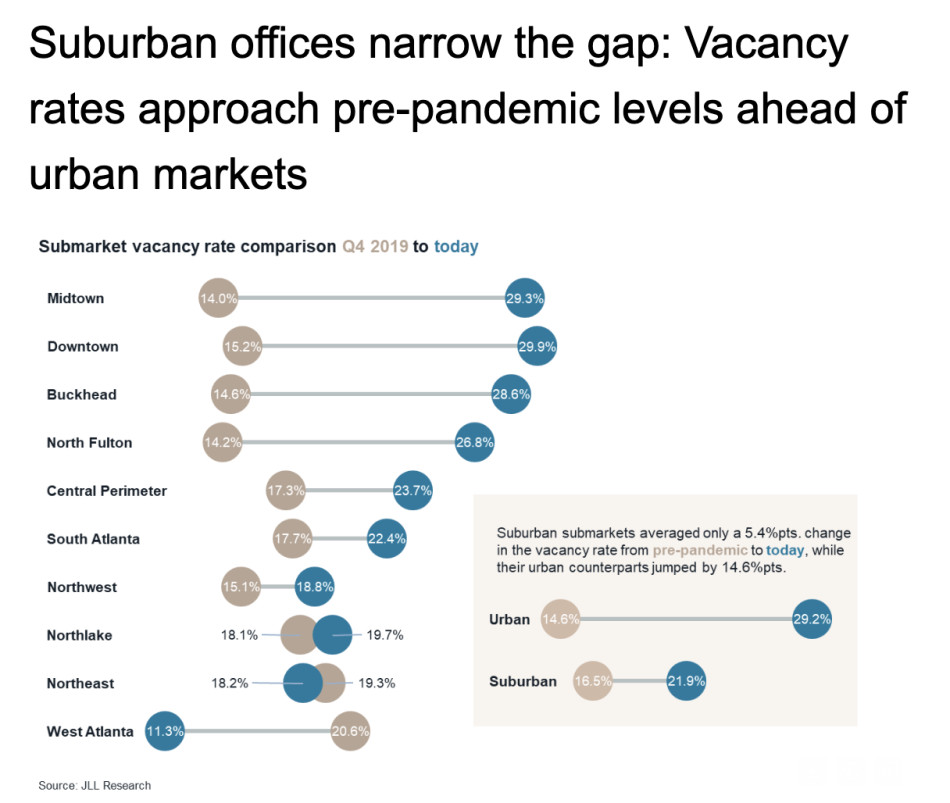

On a related note—and perhaps a somber one for development wonks—new JLL research shows Atlanta was home to exactly zero new office groundbreakings last year.

Given record vacancy levels, that’s not surprising—but it does make for the lowest office pipeline since the 1980s in Atlanta, per JLL.

The more positive news is that trophy office assets continue to see positive absorption in the city, driven by what’s called the “flight-to-quality” trend.

Meanwhile, according to JLL’s findings, office markets in Atlanta suburbs are rebounding faster than the urban core’s. OTP vacancy rates are plummeting and starting to approach pre-pandemic levels overall, in fact.

Factors driving that trend include: the fact that suburban areas saw a less dramatic vacancy increase during the pandemic; tenants “right-sizing” and shifting to cheaper, more flexible suburban markets for space; and outdated suburban office supply being yanked from inventory to balance supply and demand, per JLL’s research.

...

Follow us on social media:

Twitter / Facebook/and now: Instagram

• Report: ATL home prices ballooned nearly 60 percent since pandemic (Urbanize Atlanta)