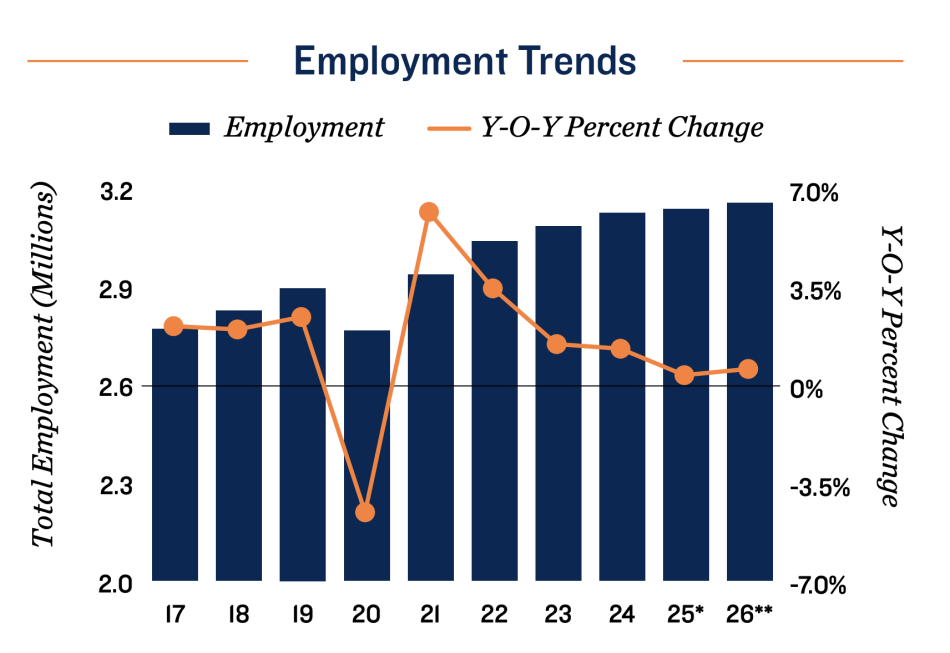

Metro Atlanta is expected to emerge as a leader in job growth among U.S. markets this year, which could be a boon for apartment landlords and multifamily property owners but put renters in more of a pinch.

That’s a key localized takeaway from the 2026 Atlanta Multifamily Investment Forecast Report, an analysis compiled by Marcus & Millichap, a commercial real estate brokerage firm specializing in investment sales, research, financing, and advisory services.

Atlanta and surrounding counties are forecasted to pack on 19,000 new jobs in 2026—good for the fourth-highest gain among major U.S. metros, according to the Marcus & Millichap analysis.

Included in those jobs, “office-using employment” is expected to grow by roughly 4,500 new roles, which is also the fourth highest among U.S. cities.

Also in the positive news category: Atlanta will continue to rank among the top U.S. metros for in-migration; combined with “easing supply” of existing apartments, that dynamic is expected to lower apartment vacant rates across the metro to 5.2 percent, according to the study.

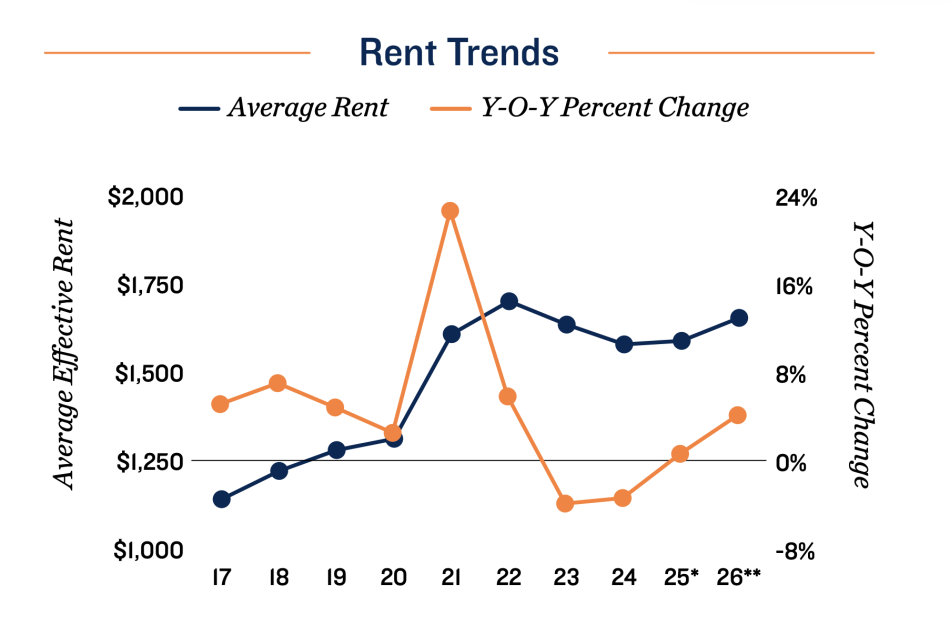

The shrinking supply in metro Atlanta is forecasted to reverse two years of declining rents. Atlanta, in fact, is expected to rank second among major markets for highest mean effective rent growth, with the local average climbing to $1,650 per month this year.

For development wonks, the more troubling projections hinge on new multifamily building completions.

The roughly 8,400 units projected to be delivered in 2026 across the metro is a dip of nearly half from last year, “resulting in the metro’s slowest development pace in over a decade,” per Marcus & Millichap analysts.

Nonetheless, core submarkets from downtown to Buckhead, as well as some “select” suburbs, have seen renter demand exceed supply additions in both 2024 and 2025—despite a 7 percent expansion to Atlanta’s inventory over the past three years.

That’s cut vacancy to its lowest level since the post-pandemic recovery years, according to the study.

“Even as new development slows, Atlanta’s steady job growth and population gains are helping to keep apartment demand resilient,” said John M. Leonard, Marcus & Millichap’s senior managing director and Atlanta market leader, in a statement.

Downtown Atlanta's skyline in summer 2024, when Centennial Yards was much less vertical than today near Mercedes-Benz Stadium. Christopher V Jones/Shutterstock

Downtown Atlanta's skyline in summer 2024, when Centennial Yards was much less vertical than today near Mercedes-Benz Stadium. Christopher V Jones/Shutterstock

Below is a potpourri of other takeaways—both positive and not—that stood out in the 69-page new report:

- Regarding supplies of multifamily buildings, Atlanta and Charlotte “appear well positioned after 2025, when they collectively made up more than 40 percent of the units absorbed across the Southeast.”

- Average prices for metro Atlanta apartment properties were “among the lowest of any primary metro last year, a dynamic that should attract investors from outside Georgia to area listings in 2026.”

- Over the past five years, the top 10 metros for net in-migration include: all major Texas cities, Phoenix, Atlanta, Orlando, Tampa, Charlotte, and Raleigh. “Well-located apartments across this group of Sun Belt markets remain high on investors’ target lists,” analysts noted, “as each will likely rank among the nation’s top relocation destinations through at least 2030.”

- Almost every major U.S. rental market entered 2026 with an “affordability gap” of more than $1,000. That is, the difference between a metro’s average effective rent and mean monthly payment on a fixed-rate, 30-year mortgage. “These disparities,” notes the study, “and expectations for mortgage rates to remain volatile, point to only a select number of renters buying a home in 2026.”

- “White House policies play a role in development pullback,” Marcus & Millichap analysts concluded. “Stricter enforcement of President [Donald] Trump’s immigration mandates will tighten the construction labor pool in 2026. As such, workforce shortages are likely to materialize in certain metros.”

- Nonetheless, a combination of “recent Federal Reserve rate cuts, a broader lender pool, and higher available leverage should allow more deals to pencil in 2026. Already, investment activity improved by more than 15 percent in 2025.”

Follow us on social media:

Twitter / Facebook/and now: Instagram

• Our 2026 wishlist for a better Atlanta. What's yours? (Urbanize Atlanta)