Faced with higher interest rates, tighter lending, slowing demand, and societal shifts such as the WFH zeitgeist, construction trends are pointed downward in metros across the U.S. But Atlanta is one market bucking that trend and experiencing continued growth.

That’s one takeaway from a somewhat dire report released today by Dodge Construction Network, a New Jersey-based construction industry analytics company.

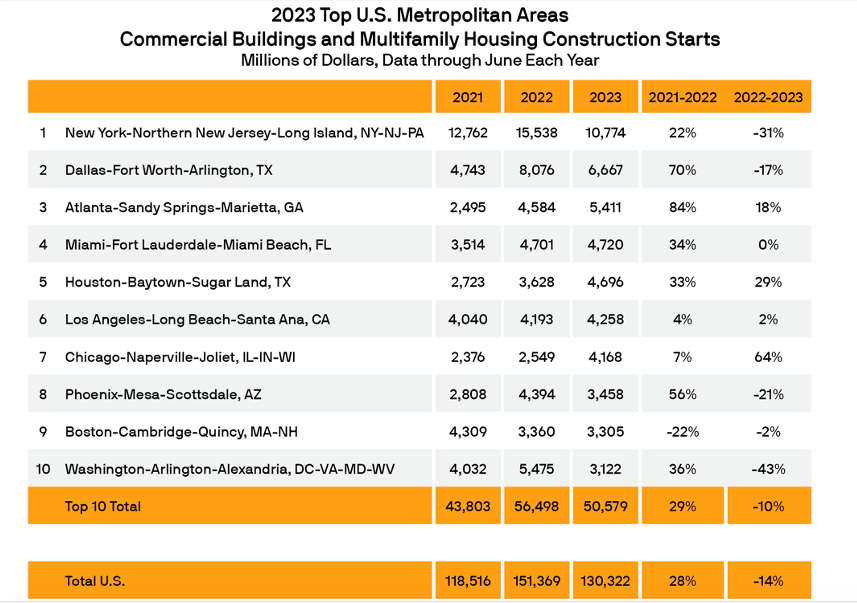

So far in 2023, the firm found the sheer amount of commercial and multifamily construction starts in the top 10 U.S. metros has dipped by 10 percent—and 14 percent overall—relative to the first half of 2022.

The slowdown has been most pronounced in the Washington D.C. area, where construction starts have cratered by 43 percent this year versus 2022, according to Dodge’s findings.

Conversely, metro Atlanta has experienced an 18 percent gain in construction starts over last year’s numbers, notching about $5.4 billion in new projects breaking ground. (Consider: That’s more than twice the value of metro-wide construction starts in the first half of 2021, which felt like boomtimes as pandemic doldrums began to ebb.)

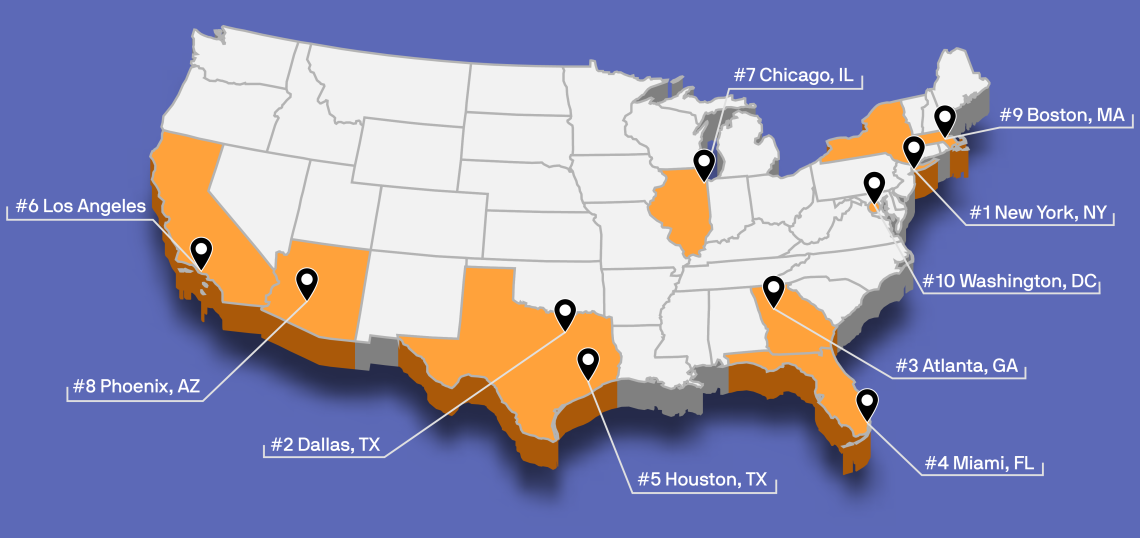

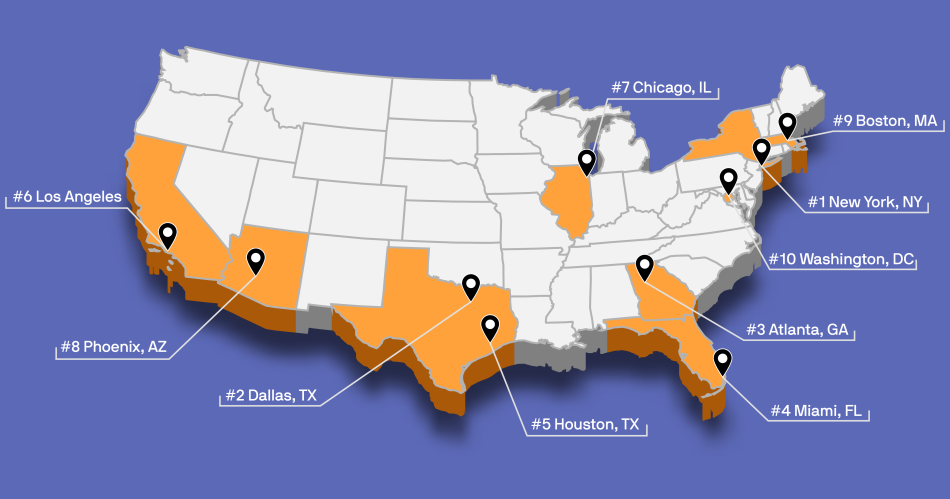

Metro Atlanta’s sheer amount of new commercial and multifamily construction this year ranks third across the country so far, trailing only greater New York ($10.8 billion) and the Dallas metro ($6.7 billion), both of which have experienced double-digit declines, per Dodge’s analysis.

Ranking of top U.S. metros for commercial and multifamily construction starts in the first half of 2023. Dodge Construction Network

Ranking of top U.S. metros for commercial and multifamily construction starts in the first half of 2023. Dodge Construction Network

Only metro Houston and Chicago have logged a bigger 2023 boost in construction starts, in terms of percentage growth through June, but the value of metro Atlanta’s new development eclipses both of those markets, according to the study.

Dodge cites specific new projects in Atlanta that have helped set the metro apart. (Metro-wide multifamily starts have dropped 23 percent since this time last year, the study notes, but a 61-percent explosion in commercial made up for that.)

Atlanta’s tallest new building in three decades—Rockefeller’s 1072 West Peachtree tower in Midtown—is noted as the biggest multifamily project to break ground in the metro this year, with an assigned value of $500 million.

In second place, per Dodge analysts, is Middle Street Partners’ two-tower, $245-million venture on Juniper Street.

On the commercial front, the $642-million first phase of Facebook’s Stanton Springs data center and another $171 million data center are cited as metro Atlanta’s largest projects to move forward this year so far.

Here’s a snapshot of where things are heading through the first half of 2023, per Dodge’s findings. These metros have produced 39 percent of all commercial and multifamily starts across the U.S. so far this year:

...

Follow us on social media:

• Discussion: How much more can Atlanta grow in our lifetimes? (Urbanize Atlanta)