If you’re starting to notice a negative trend around here, you’re not alone.

This past weekend, the Wall Street Journal published a population-analysis, urban trends piece that’s garnered a lot of buzz and reactionary media attention (not to mention schadenfreude from afar, if texts from friends in other cities are any indication). The article’s hair-raising headline: “Atlanta’s Growth Streak Has Come to an End.”

Gasp! We’re screwed! Right? Let's proceed.

The WSJ cites U.S. Census Bureau data that indicates metro Atlanta saw a dip in domestic migrants over the 12 months ending in mid-2024, enough that the region lost more people to moving away than those who moved in. The decline wasn’t severe—1,330 former residents, equivalent to basically one larger apartment complex—but it did mark the first instance of this happening in metro Atlanta in three decades, since the Census started keeping such records.

Anecdotal evidence of the region’s decline peppered throughout the WSJ piece includes Microsoft’s indefinite pause of its economy-changing Westside campus, a foreclosed apartment building in Buckhead, the metro’s scourge of office vacancies, cripplingly low housing inventory, local employer hiring called “weak,” and younger folks fed up with traffic and high rents who’ve bolted to places like Chattanooga, Greenville, and Huntsville. The metro, in summation, “is finally cooling off,” the authors assert.

Make no mistake: According to the 2024 data, metro Atlanta is still growing, with births outnumbering deaths and international migration on the uptick (at least until recently); and by all indications, the City of Atlanta itself remains on a growth hot streak, now with its highest population in history. In so many places the city certainly feels more alive, more populated and vibrant, than even five years ago.

But the WSJ’s take isn’t alone in pointing out something foul afoot around here.

Many of the Midtown high-rise rentals shown here in December 2022 delivered last year, continuing a multifamily boom. Urbanize Atlanta

Many of the Midtown high-rise rentals shown here in December 2022 delivered last year, continuing a multifamily boom. Urbanize Atlanta

Back in March, Census estimates showed that metro Atlanta was being stripped of what many urbanists considered a point of pride: being the sixth largest metro in the U.S.

According to those 2024 estimates, the metro areas of both Miami and Washington D.C. leapfrogged Atlanta’s in terms of overall population, bumping Georgia’s capital city back to No. 8 on the list of largest metros in the country. (A year prior, a similar report showed metro Atlanta had surpassed both Miami and Washington D.C.—after having overtaken metro Philadelphia—to become the sixth largest U.S. metro and the biggest in the Southeast. But that party was short-lived, per the data.)

More recently, findings from a leading real estate marketplace show an abnormal pricing dip around Atlanta.

In fact, bottom-of-the-barrel abnormal—and unfamiliar territory for a Sunbelt boomtown, traditionally speaking.

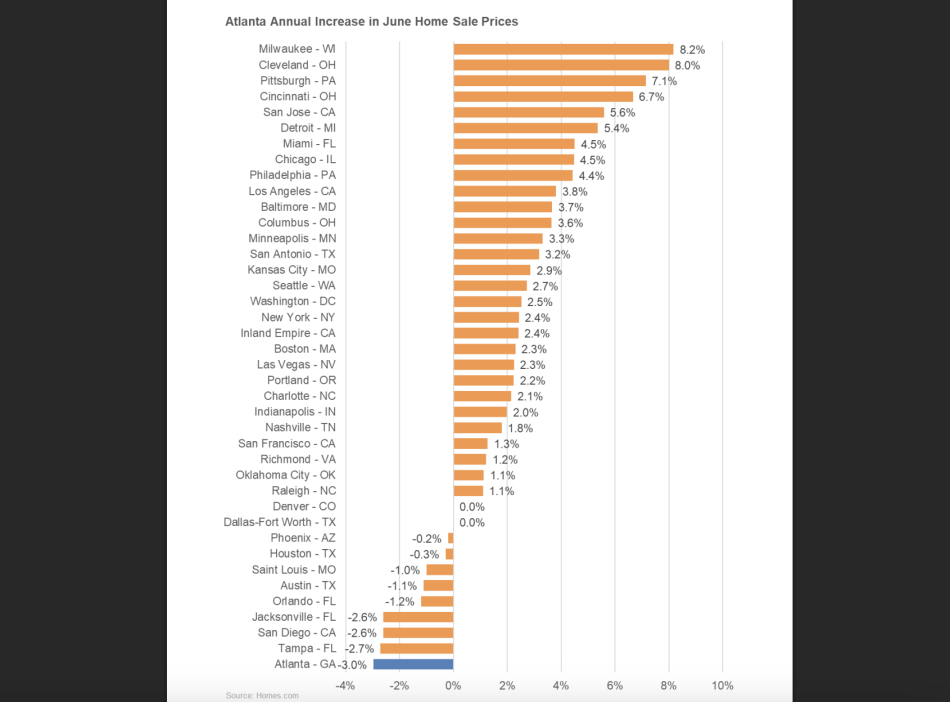

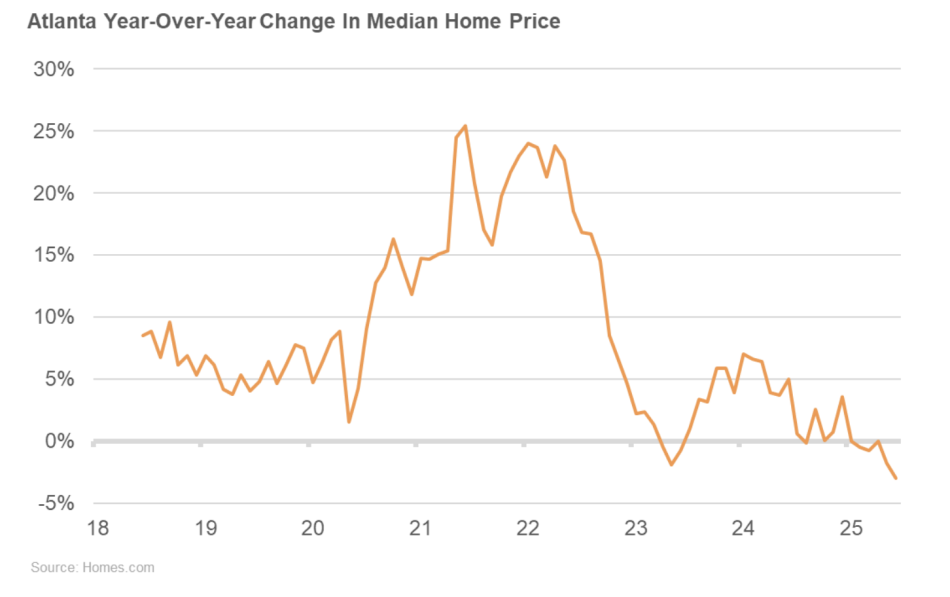

According to Homes.com, the metro’s median home prices dropped by 3 percent in June compared to last year, marking the most significant year-over-year decrease in home prices across the nation. It also marked metro Atlanta’s biggest dip since the tail end of the Great Recession in July 2012. Metro Atlanta condos (down 6.1 percent) and townhomes (6.5 percent) took the biggest price hit.

Per Homes.com’s analysis, metro Atlanta’s median home price is $407,500, down about $12,500 from last June, which is leaning in favor of homebuyers though interest rates remain relatively high.

What’s more, active home listings around Atlanta ballooned by 40 percent over the year ending in June, signaling a slowdown but helping to give buyers leverage.

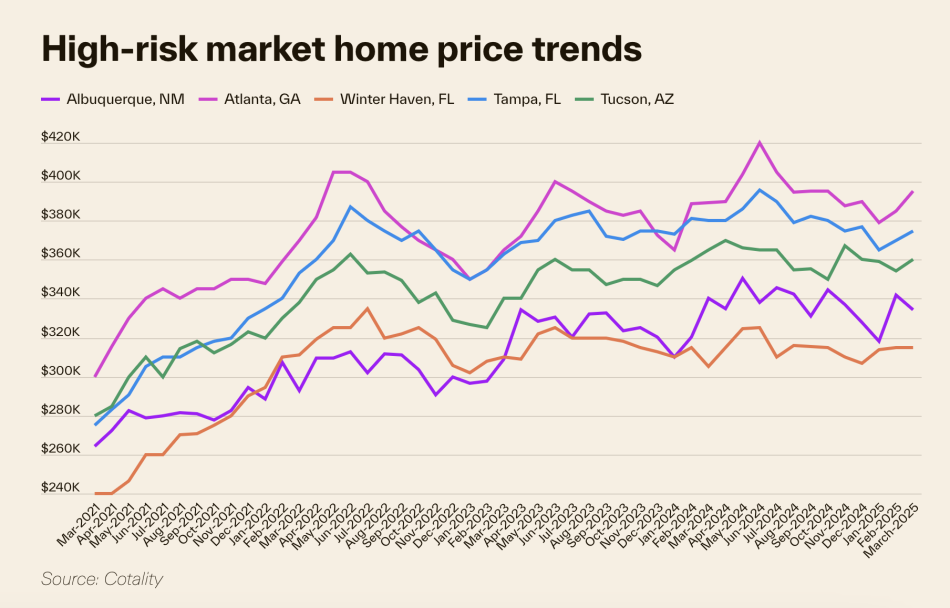

Another recent report by analytics firm Cotality (formerly CoreLogic) found Atlanta to be the country’s No. 2 market at “very high risk of price decline.”

That trend “is thought to be due to buyers being unable to afford home prices as they currently stand …, rising home inventory in Atlanta putting pressure on sellers to reduce prices to stay competitive, and rapid rising prices of homes since the COVID-19 pandemic,” reads a summary.

Could all the above be proof of the dreaded “B” word (rhymes with “rubble”) in Atlanta? Are we doomed? Or are the alarm bells overblown? Will the city and metro quickly course-correct as we’ve done, by and large, for a century and a half? Is it too late now?

Certainly food for thought. Gulp.

...

Follow us on social media:

Twitter / Facebook/and now: Instagram

• Opinion: These Atlanta neighborhoods are still a smart buy in 2025 (Urbanize Atlanta)