If media reports about lonely doughnuts and ghostly boardrooms seem perplexing when so much office construction is underway across Atlanta, a recent CBRE analysis could help make sense of what’s happening—and why the local outlook appears relatively strong.

Several indices point to a healthy office market in Atlanta, all things considered, despite a COVID-19 delta variant that’s upended many companies’ plans for a return to offices en masse this fall, according to CBRE, a global leader in commercial real estate investment and services.

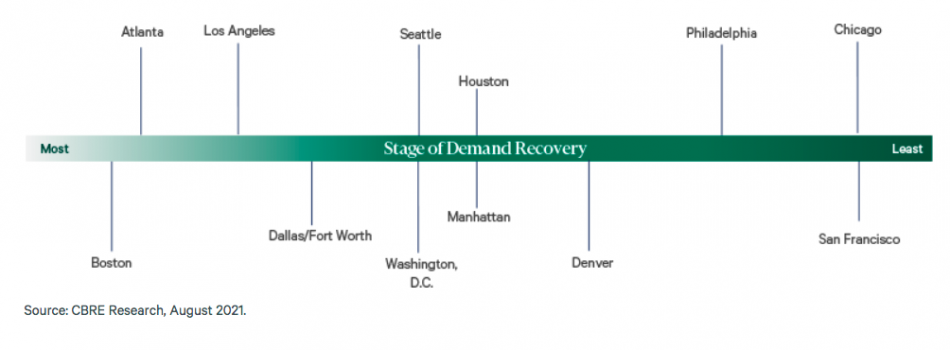

CBRE’s August findings peg metro Atlanta as the second-most recovered market among the 12 largest U.S. cities in terms of office demand, trailing only Boston.

The data use three metrics—leasing activity, tenants seeking space in the market, and less-desirable subleasing availability—to “provide early indications of when and where momentum in office demand may be shifting,” per CBRE.

Overall, office demand slipped in August as COVID-19 infections surged, after having increased steadily for the first six months of 2021. Space available for subleasing remains prevalent in the country’s largest markets, CBRE found.

Atlanta stood out in two indices in particular, per the August report.

The metro tallied the largest growth in the country in terms of month-over-month leasing activity, besting only four other markets that saw conditions improve: Houston, Manhattan, San Francisco, and Chicago, respectively.

Atlanta also scored the country’s largest increase of square footages required by tenants in the market heading into the fall. Only three other markets—Dallas/Fort Worth, Seattle, and Philadelphia—bucked the national downward trend.

“While the decline (in square footage requirements) partially results from the conversion of some (tenants in market) to leases,” CBRE analysts noted, “it also reflects renewed caution on the part of office occupiers.”

Norfolk Southern's new 750,000-square-foot Midtown headquarters is expected to eventually house nearly 3,000 employees, relocated from other markets and elsewhere in Atlanta. Jonathan Phillips/Urbanize Atlanta

Norfolk Southern's new 750,000-square-foot Midtown headquarters is expected to eventually house nearly 3,000 employees, relocated from other markets and elsewhere in Atlanta. Jonathan Phillips/Urbanize Atlanta

Optimism for office development has been prevalent across Atlanta—especially in Midtown or places connected to the BeltLine—throughout the pandemic. Much of it has been speculative, with scales that have varied widely.

Examples include the Lee + White district’s expansion in West End, the Echo Street West project’s office component in English Avenue, Colony Square’s extensive redo in Midtown, and New City’s Fourth Ward mega-project fronting the Eastside Trail, among many others.