A recent photo tour in the skies over Midtown revealed a glaring omission: the forest of construction cranes that had been a mainstay in the subdistrict for the better part of a decade.

We've hardly encountered a scenario like the development dead zone and no-growth wasteland of the Great Recession. But there are data-driven reasons for the changes in a perennially hot district like Midtown, according to a year-end analysis compiled by Multifamily Acquisition Advisors, a Dallas-based real estate investment firm.

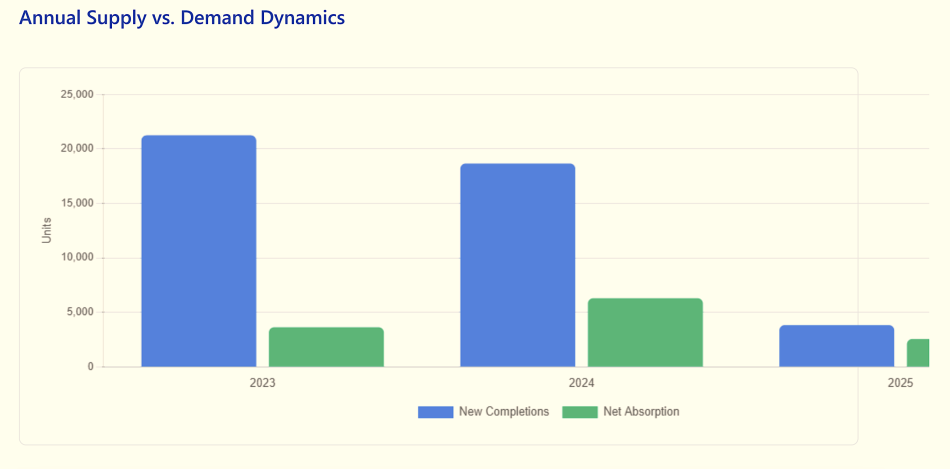

Across metro Atlanta, multifamily projects saw more than 21,200 units completed in 2023, but throughout this year, that number has plummeted to 3,831 units. That’s a drastic 82-percent reduction.

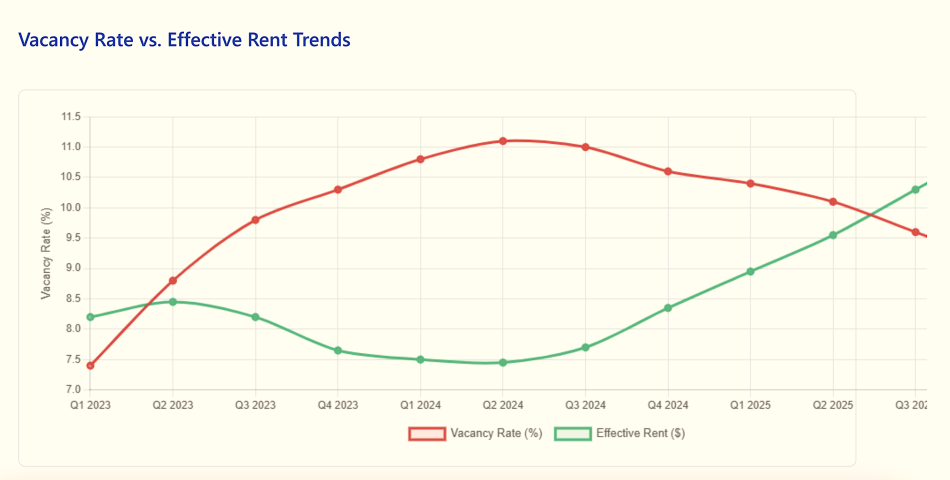

“We wrote off Atlanta for a bit when 21,000 new units were delivered [two years ago] and sent vacancy soaring to 11.1 percent and rents tumbling,” Christopher Thomson, a Multifamily Acquisition Advisors managing principal, wrote in a report summary.

Data indicates a “sea change” is afoot and that multifamily construction would witness a comeback soon, according to the firm’s findings.

As seen in August 2022, six cranes stood in Midtown near one intersection, where Spring Street meets 10th Street. (Projects included, from left, the two-tower Momentum Midtown; at top, Whistler student apartments; Hub Atlanta, another student-housing venture; and at bottom right, Portman's two-tower Spring Quarter development.) Urbanize Atlanta

As seen in August 2022, six cranes stood in Midtown near one intersection, where Spring Street meets 10th Street. (Projects included, from left, the two-tower Momentum Midtown; at top, Whistler student apartments; Hub Atlanta, another student-housing venture; and at bottom right, Portman's two-tower Spring Quarter development.) Urbanize Atlanta

Multifamily Acquisition Advisors crunched the numbers for a dozen quarters beginning at the start of 2023 across metro Atlanta, considering multifamily projects with at least 100 units.

The findings could be sweet music to the ears of the development community—but a tougher pill for renters.

The local multifamily market underwent a “dramatic supply-demand imbalance” from 2023 to mid-2024, but that’s been followed by a “meaningful recovery,” during which rents have grown for seven quarters in a row while vacancy compressed 200 basis points from its peak, per the firm’s findings.

That means average rents are up about 4 percent from the second quarter of 2024, back when vacancies crested over 11 percent as massive new supply materialized.

According to Thomson’s firm, metro Atlanta reached a turning point in late 2024. That's when completions fell off a cliff and vacancies dipped to just over 9 percent overall—closer to the “pre-surge” 7 to 8 percent vacancy rates that characterized the metro in early 2023.

Of the seven consecutive quarters for rent growth, the most recent quarter saw the highest rate (.9 percent), which signals “robust market health,” per the study.

Effective rents this quarter stand at $1,641, or 3.6 percent above early 2023. Fewer than 4,000 units have finished in 2025, creating "tailwind for continued rent growth.”

Meanwhile, per the analysis, the pipeline of 9,755 units under construction metro-wide is considered “reasonable” supply in the near term, given current absorption rates.

“Atlanta's recovery is a case study in how quickly oversupply can correct when new construction slows,” reads Thomson’s recap. "Atlanta has fully recovered and is entering a growth phase."

...

Follow us on social media:

Twitter / Facebook/and now: Instagram

• Rockefeller Q&A: Tallest ATL tower since 1990s has risen. Now what? (Urbanize Atlanta)